Copper blog

Productivity - 5 min READ

8 Ways project management keeps your team from losing it

See how agencies use our project management tools to streamline onboarding, manage complexity, and deliver work without burning out.

6 min READ

How to use Google Sheet CRM templates

Use Google Sheets as a CRM with Copper’s free template. Learn how to build your own CRM spreadsheet and when to upgrade to a real CRM system.

Client success

No, your account manager shouldn’t also be your project manager

Why merging account manager and project manager roles hurts your team, clients, and delivery.

Productivity

"I'll just do it myself" and other lies we tell ourselves

How outsourcing your work can help your agency grow, scale, and stop running on burnout.

Productivity - 4 min READ

Build, track, pitch: How PR agencies use CRMs for media outreach

Everything you need to manage journalism contacts without Cision, Meltwater or MuckRack.

Get the latest from our blog every month

Browse the blog

Want to go deeper? Click on a category below for more from Copper.

Popular

5 min READ

CRM Wrapped 2024: Your year in CRM wins

How did customer relationship management (CRM) platforms shape businesses like yours?

6 min READ

How to spot a slow season and thrive through it

Learn how to plan ahead, refresh your strategy, and make the most of quiet times for your agency.

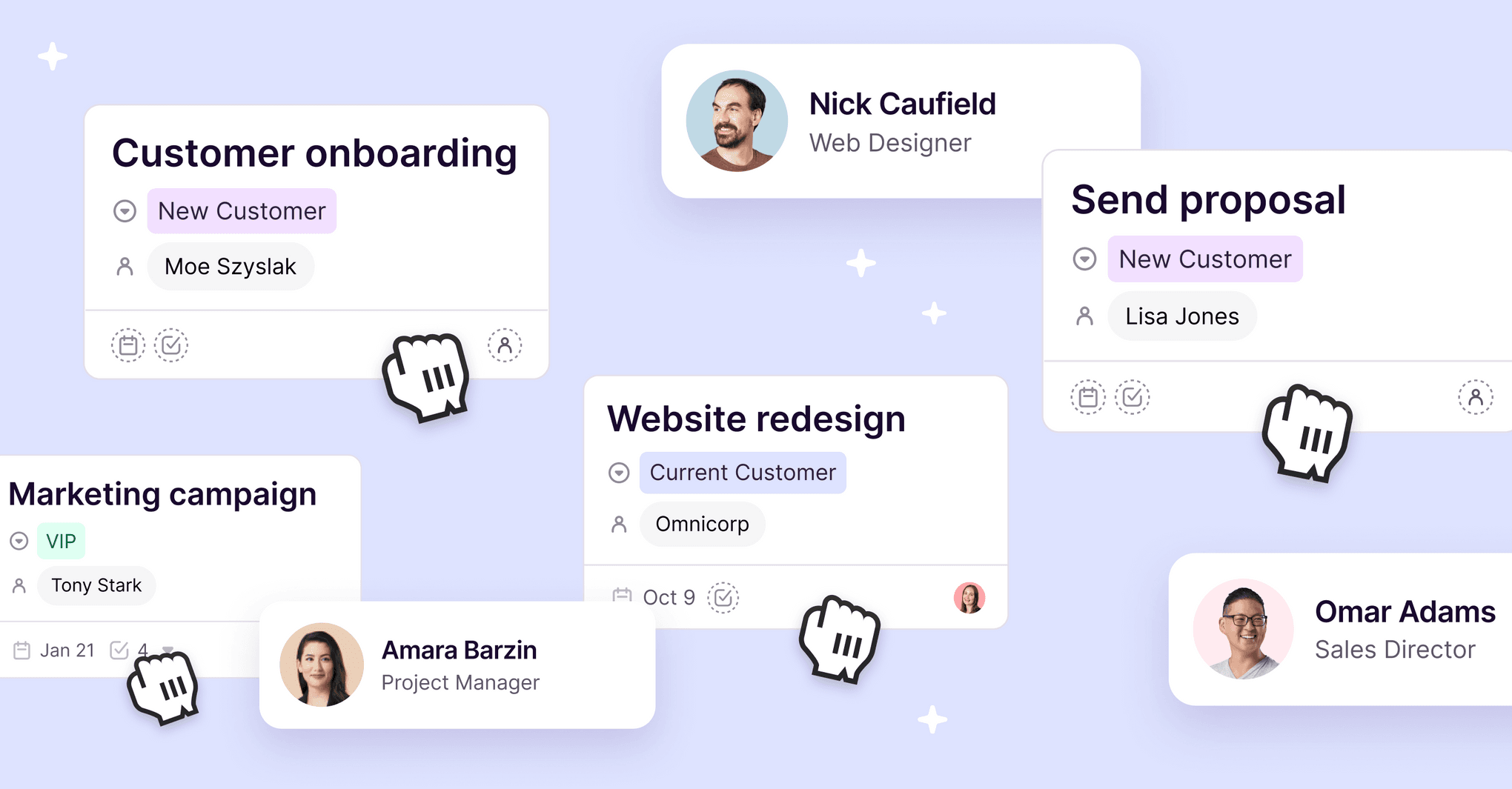

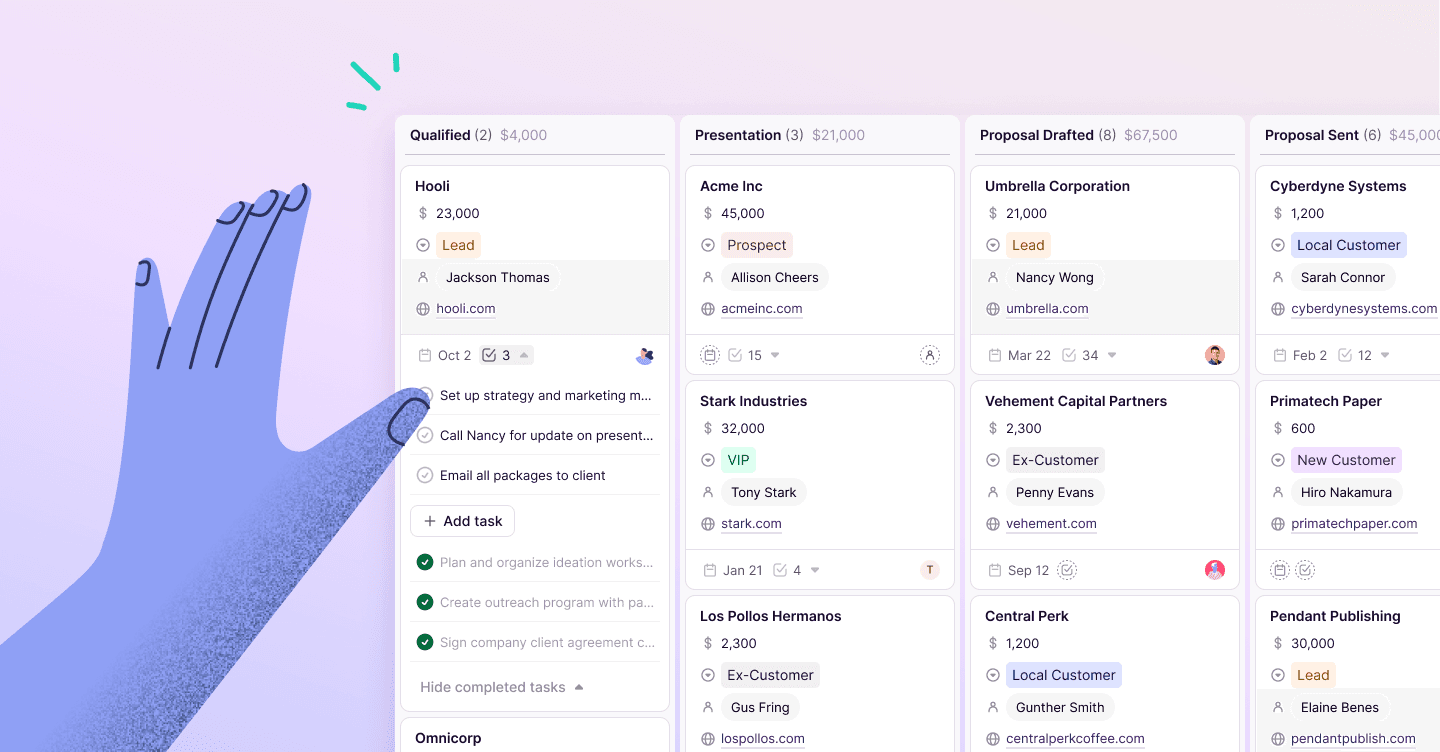

How to apply Copper's Pipelines to your workflows for success

Boost your productivity with Copper CRM's newest upgrades and features.

8 min READ

How to say "thanks" to a client or customer for their business

Learn how to thank customers effectively with our guide. Discover strategies for sending personalized thank you notes and emails that strengthen your business relationships.

Productivity - 4 min READ

When did ‘wearing all the hats’ become the norm?

Burnout isn’t a badge of honor. Get the right systems in place to run things with clarity.

Productivity - 5 min READ

How to be a project manager and run your business like a pro

Lead like a project manager and keep your business organized and focused.

Sales

What sales and project managers can learn from each other

Sales and project managers don’t have to work in silos. Learn how both teams can share tips to stay aligned, hit goals, and keep clients happy.

Productivity - 5 min READ

How our customer success team uses our CRM

Customer success tips to help you build stronger relationships and deliver an experience that keeps customers coming back.

Sales - 4 min READ

4 Reasons to choose Copper vs. Pipedrive CRM

Looking for a new CRM and evaluating Pipedrive alternatives? Here’s a closer look at how Copper vs. Pipedrive compare.

Marketing - 5 min READ

The art of rekindling relationships and how Copper helps you do it

Rekindle client relationships with smarter, personalized follow-ups.

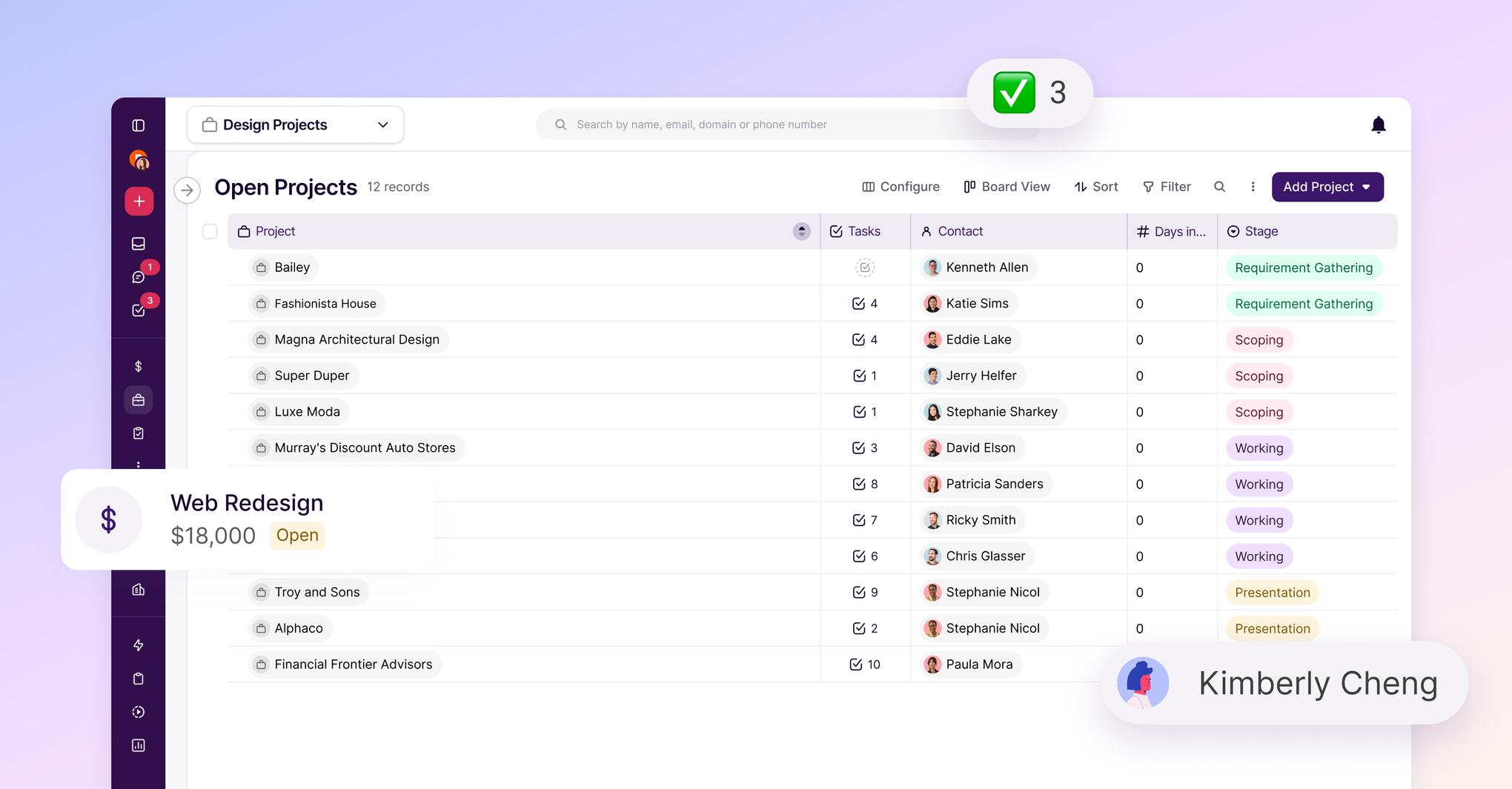

Productivity - 7 min READ

CRM productivity begins with lists

CRM users spend most of their time in list view, so we’ve created an experience that is speedier and more efficiency for your daily workflow.

Sales - 10 min READ

7 Tips to Prevent Sales Burnout

Learn about the signs of burnout unique to salespeople and 7 simple ways to prevent sales burnout.

9 min READ

How to host a lead gen webinar with Google Meet video conferencing

Let's dive into how you can schedule a Google Meet video meeting for your next virtual event and 6 things you need to have on your video conferencing

4 min READ

5 ways to use CRM and project task management for small businesses

Learn how CRM task management tools work, why you need them and 5 creative ways to use these tools in your own business. Read more!

Productivity - 6 min READ

You’re not ‘too small’ for a CRM

Struggling to stay organized? A CRM might be your best next move.

Sales - 6 min READ

How to create an ideal customer profile (ICP)

Learn how to create a detailed ICP to effectively identify and focus on your ideal customers.

5 min READ

How to use Copper's LinkedIn CRM integration

How Copper’s LinkedIn CRM integration streamlines client outreach and relationship-building

Productivity - 4 min READ

Hiring your first freelancer (and how to work with them)

Hiring your first creative freelancer? Read this before you post a job description.

Productivity

The future of media is community-driven—here’s how to keep up

Clicks are out, community is in—let’s talk about why.

Productivity - 8 min READ

5 Ways to use Pipeline email automations that save your team time

Save hours with smarter email follow-ups that scale with you and help you never miss a beat

Sales - 9 min READ

Stop losing customers with the 7 strategies we use

Stop losing customers! Keep them with smarter onboarding and support strategies.

Marketing - 6 min READ

How consultants can turn content marketing into a lead-gen machine

Turn your expertise into leads with content that works on autopilot.